Understanding LLCs: Key Info for Entrepreneurs

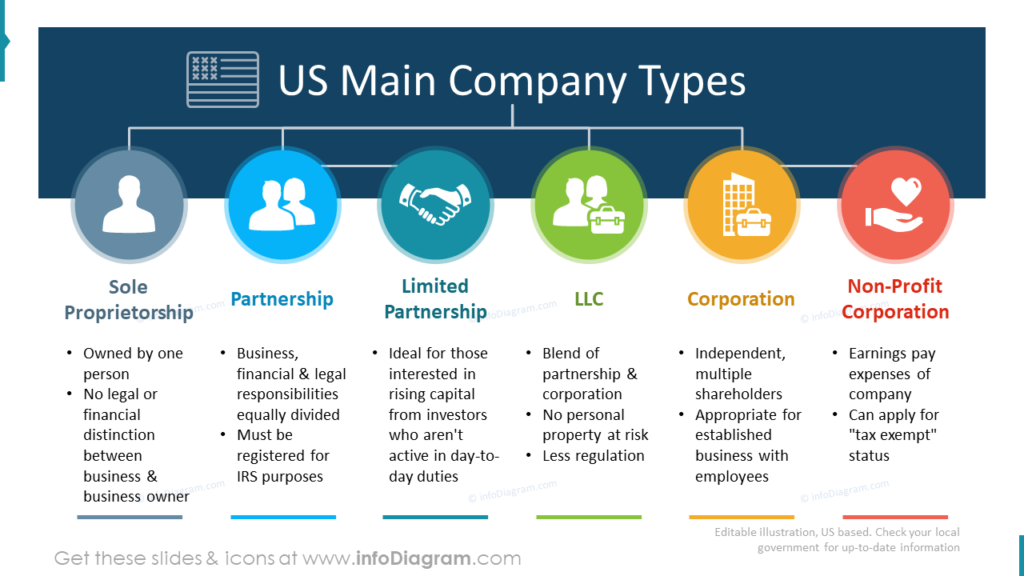

When beginning a brand-new business, selecting the ideal framework is crucial, and many entrepreneurs select a Minimal Obligation Business (LLC) because of its versatility and safety attributes. An LLC is a business framework permitted by state law that can shield individual assets from company financial debts and liabilities. This hybrid entity integrates the pass-through taxes of a partnership or sole proprietorship with the restricted liability of a firm, making it an attractive choice for little to medium-sized companies. examples of participant information sheets in the united state has particular policies for forming an LLC, which generally consist of declaring write-ups of organization with the state's Assistant of State workplace and paying a declaring charge. Past these initial steps, LLC owners, commonly described as participants, should choose just how their entity will be managed— either member-managed or manager-managed— which influences daily procedures and decision-making procedures.

The operational adaptability of an LLC is boosted by the lack of a need for annual conferences or official policeman functions, unlike firms. However, to keep the integrity of the LLC and the limited liability security, it is critical for members to abide by certain techniques such as keeping individual and organization financial resources separate. A lot of states require LLCs to preserve a registered representative that receives main communications on behalf of the firm. An additional considerable benefit of an LLC is the capability to pick how it is tired. By default, LLCs are dealt with as pass-through entities for tax obligation objectives, meaning that company revenue is strained just at the individual degree, preventing the dual taxes commonly related to C companies. An LLC can choose to be strained as a company if that is much more helpful for the organization's financial situation. This adaptability permits entrepreneur to adjust their frameworks according to their developing needs and market problems, possibly maximizing their tax obligation obligations and enhancing productivity.

Recognizing Restricted Liability Business (LLCs)

A Minimal Obligation Firm (LLC) is a preferred company structure among entrepreneurs across various markets because of its adaptable nature and safety functions. Essentially, an LLC mixes the qualities of both companies and partnerships, using the limited responsibility defense of a company with the tax efficiencies and operational adaptability of a partnership. This hybrid framework makes it an appealing choice for organization proprietors seeking to reduce their individual risk while preserving control over service choices. Among the fundamental advantages of an LLC is that it shields its participants from personal liability for company debts and cases, which means that when it comes to financial failure or legal issues, the personal properties of the members, such as automobiles, financial savings, and homes, are usually shielded. One more enticing element of LLCs is their tax adaptability. Unlike a corporation, which goes through double taxation— when at the company degree and once again on returns— LLCs appreciate pass-through taxes. This suggests that the LLC itself does not pay tax obligations straight; rather, revenues and losses are gone through to participants, that report them on their individual tax obligation returns, potentially causing considerable tax obligation financial savings. Furthermore, LLCs are relatively very easy to establish up and take care of, with much less documentation and fewer recurring demands contrasted to companies. This convenience of administration typically makes LLCs excellent for smaller sized services or those simply starting, that may not yet be ready to manage the complexities of a full-fledged company. The flexibility in administration structure is an additional vital feature of LLCs. Participants can pick to handle the company themselves, or they can select supervisors that might or might not be participants. This can be particularly helpful in circumstances where the members are not experienced in the daily operating of an organization and like to employ skilled individuals to take care of these aspects. The ability to tailor the operating contract, which establishes forth the policies concerning the organization operation and the connections among the members, offers a degree of operational control that is not as easily offered in other company types. This personalization can make certain that the certain requirements and objectives of business and its members are met, making the LLC an extremely versatile option for a large range of business activities.

Comprehending the Structure and Benefits of Limited Responsibility Companies (LLCs)

The Minimal Responsibility Company (LLC) is a prominent company structure within the United States, kept in mind for its versatility and the protection it uses to its participants. An LLC integrates aspects of both collaborations and company frameworks, fundamentally making sure that members are not directly responsible for the firm's financial obligations or liabilities. This type of business entity can be developed with several members, and unlike companies, there is no requirement for an LLC to hold annual meetings or record mins. Additionally, LLCs are eye-catching as a result of their tax obligation advantages. They normally delight in pass-through taxation where as opposed to the company itself being exhausted, the earnings and losses are passed with to specific members to report on their individual tax obligation returns. This avoids the double taxes typically experienced in corporations. The operational adaptability of an LLC is likewise a substantial benefit. While firms are required to have a set management structure with officers and directors, LLCs allow participants to straight manage the organization or to select managers to do so. This can be specifically advantageous for smaller sized services that do not wish to handle the rules of corporate governance. Furthermore, LLCs can be created for a vast array of objectives, from straightforward property holding companies to complex production procedures, dealing with the needs of diverse business markets. An additional crucial aspect of LLCs is the ease with which they can be established and preserved. The procedure entails submitting the Articles of Organization with the ideal state authority and paying a declaring fee, which varies by state. The requirements can vary, generally, an LLC is less complicated to set up contrasted to a company and requires less continuous procedures. This simpleness makes it an enticing option for business owners that want to stay clear of cumbersome governing requirements while still gaining from limited liability protection. Finally, the LLC is a adaptable and reliable lawful framework that is ideal for many various kinds of company endeavors. Its mix of restricted liability protection, taxation benefits, and functional flexibility makes it an eye-catching alternative for organization owners seeking to decrease administration while still securing their individual properties. Whether for a multi-member financial investment or a tiny start-up group, the LLC framework supplies an engaging mix of convenience and security.

Understanding the Framework and Benefits of an LLC

Restricted Liability Business (LLCs) offer an adaptable service structure that incorporates the pass-through taxes of a partnership or single proprietorship with the restricted responsibility of a firm. This makes LLCs particularly appealing for tiny to medium-sized companies. An LLC is reasonably simple to maintain and create, needing much less strict conformity measures compared to corporations. For example, while companies are mandated to hold annual conferences and keep comprehensive documents of choices and meetings, LLCs do not have such rigid requirements, enabling an extra versatile administration style. LLCs offer substantial flexibility in profit distribution. Unlike corporations where earnings must be distributed symmetrical to the amount of shares each shareholder holds, LLC participants can concur on any kind of plan of revenue sharing that fits their requirements. This can be especially advantageous in situations where participants add various quantities of time, effort, or resources. Additionally, the liability security used by an LLC guards its owners' individual properties from service debts and cases. In the occasion of lawful action or service failure, the personal possessions of the participants, such as personal checking account, homes, and various other financial investments, are generally safeguarded. It is essential for LLC members to keep a clear difference in between individual and company funds to uphold this defense. Creating an LLC additionally supplies a reputation increase to a company, as the 'LLC' classification can improve a business's professional picture, possibly attracting even more customers and financiers. LLCs frequently delight in tax obligation benefits, such as the capability to select exactly how they are taxed (either as a corporation, collaboration, or as an ignored entity), supplying significant flexibility and possible tax obligation cost savings depending on the service's specific scenarios.

Comprehending LLC Monitoring and Control Structures

When developing a Limited Obligation Company (LLC), recognizing the monitoring and control structures is imperative for making sure the entity operates smoothly and successfully. An LLC can be handled by its members (proprietors) or by appointed supervisors. This adaptability permits the LLC to either be member-managed, where all participants take part in the decision-making procedures, or manager-managed, where either an outsider or a member is assigned to manage the LLC's everyday operations. In a member-managed LLC, the structure is similar to a partnership, cultivating an autonomous ambience where each participant has a say in company affairs, based upon their percent of ownership or an agreed-upon setup. Alternatively, a manager-managed LLC appears like a business framework, where the managers work as the company's executives, freeing the members from everyday administration tasks and permitting them to focus on wider critical goals. The option between these monitoring frameworks influences whatever from the LLC's functional efficiency to how decisions are made and carried out. The operating contract, an important paper for any type of LLC, must plainly lay out the governance structure and provide in-depth standards on the functions and duties of all involved, guaranteeing that there are no ambiguities in managerial authority or member obligations. This document offers not only as a lawful framework for the organization yet additionally as a roadmap for the LLC's procedure, aiding to protect against problems and complication down the line, hence making it a crucial aspect in the foundation of a robust management and control system within an LLC.